Austin enters 2026 with one of the most closely watched housing markets in the nation. After the dramatic highs of 2020–2022 and the correction that followed, the city is now settling into a more balanced, opportunity-rich market for both buyers and sellers.

If you’re planning to buy, sell, invest, or simply track the market in 2026, here’s everything you need to know — explained clearly and simply.

1. The Big Picture: What’s Happening in Austin Real Estate Right Now?

The Austin market in 2026 is defined by three major trends:

Trend 1: Stabilized Prices After Years of Volatility

Prices have flattened compared to the sharp swings of previous years. Instead of rapid appreciation or steep drops, 2026 is showing steady, moderate movement, creating a more predictable market for long-term planning.

Trend 2: Higher Inventory = More Buyer Options

Austin continues to experience increased housing inventory, particularly in:

- New construction communities

- Southwest Austin

- Buda, Kyle, Leander, Georgetown

- Move-up residential neighborhoods

More choices mean buyers can shop more confidently and negotiate more effectively.

Trend 3: A “Normalizing” Market

The frenzy is gone. Fewer bidding wars, more price adjustments, but no signs of a dramatic crash.

The market is balancing, creating a healthier environment for consumers.

2. What Buyers Need to Know in 2026

If you’re thinking of buying this year, here are the key insights to guide your decision:

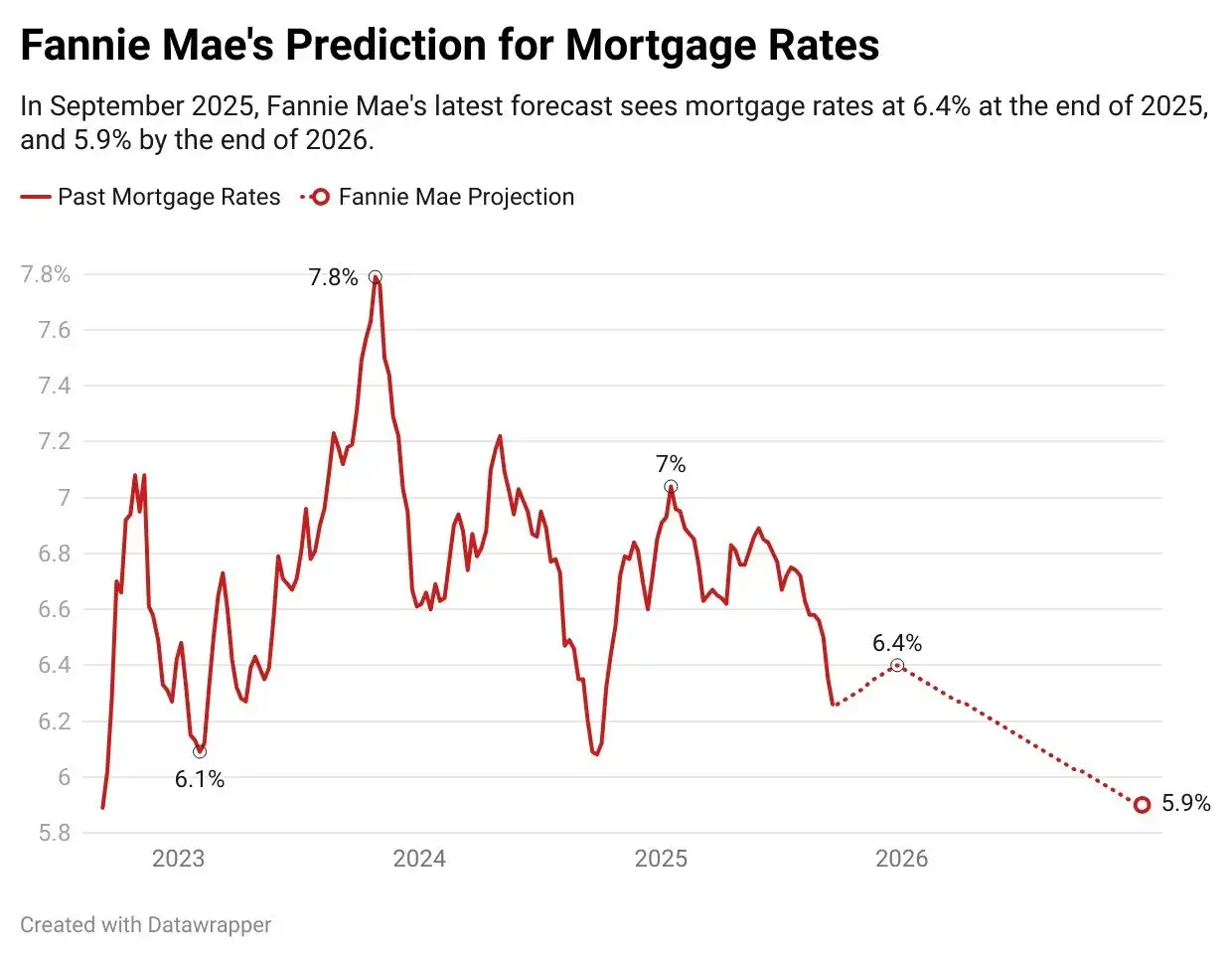

Mortgage Rates Are More Predictable — And Here’s What Experts Expect

While mortgage rates remain higher than during 2020–2021, they have settled into a more stable pattern. Most major forecasters (Fannie Mae, MBA, NAR) expect 2026 rates to fall somewhere between 5.75% and 6.5%, depending on inflation, employment, and Federal Reserve policy.

Builders Are Still Offering Strong Incentives

With many communities carrying inventory, buyers are seeing:

- Rate buydowns

- Closing cost assistance

- Free or discounted upgrades

- Price reductions on quick-move-in homes

This is one of the most favorable environments in years for new construction buyers.

Buyers Have More Negotiation Power

More inventory and longer days on market give buyers leverage, especially on:

- Price adjustments

- Repairs

- Closing timelines

- Seller-paid credits

This marks a major shift compared to the competitive 2021–2022 period.

3. What Sellers Need to Know in 2026

Selling in 2026 is still highly possible and profitable — but strategy matters more than ever.

Today’s Buyers Are More Selective

With more options available, buyers expect:

- Updated finishes

- Good maintenance

- Competitive pricing

- Move-in readiness

Homes that feel “fresh and ready” outperform dated properties.

Pricing Correctly Is Essential

Gone are the days of overpricing and letting the market catch up.

Sellers who price based on real 2026 comps and buyer expectations see faster offers and higher net proceeds.

Concessions Are Becoming Normal

Many sellers offer:

- Closing credits

- Rate buydowns for buyers

- Repair allowances

Not because the home is undesirable — but because the market rewards sellers who help buyers manage affordability.

High-Equity Sellers Have a Major Advantage

If you’ve owned your home for 5+ years, your equity remains strong.

This provides flexibility with pricing, timing, and negotiations that newer sellers simply don’t have.

4. 2026 Austin Real Estate Trends to Watch

These key trends will shape housing throughout the year:

Growth Continues in the Suburbs

Demand remains strong in areas offering schools, amenities, and better affordability. Expect steady activity in:

- Buda & Kyle

- Leander & Liberty Hill

- Georgetown

- Southwest Austin

New Construction Supply Will Continue to Influence Pricing

As builders work through inventory, incentives may remain attractive — giving buyers leverage while pushing resale sellers to stay competitive.

Luxury Market Remains Stable

Westlake Hills, Barton Creek, Great Hills, and Davenport Ranch continue attracting relocators and high-income buyers.

Investors Are Reentering the Market

As rents stabilize and prices level out, long-term investors are becoming more active, focusing on sustainable cash flow rather than speculation.

5. So… Should You Buy or Sell in 2026?

A simple way to frame the decision:

Buying May Be Smart If You:

- Find a home that fits your needs

- Want to leverage builder incentives

- Plan to stay in the home 3+ years

- Prefer to buy before competition intensifies again

Selling May Be Smart If You:

- Have strong equity

- Are prepared to price strategically

- Are open to incentives that attract buyers

- Have a well-maintained or updated home

In short: 2026 rewards informed buyers and strategic sellers.

6. How Unda Realty Group Supports You in 2026

Whether you’re buying or selling, strategy matters. Our team offers:

- Local neighborhood market analysis

- Builder incentive comparisons

- Pricing strategies to maximize profit

- Investment forecasts

- Side-by-side “Buy Now vs. Wait” financial models

- Negotiation strategies tailored to today’s conditions

Our goal is not just to help you move — but to help you make the best long-term decision.

Ready to Make a Move in 2026? Let’s Talk.

Whether you’re considering buying, selling, or investing this year, you deserve clear information and expert guidance.

Contact Unda Realty Group today for a personalized market consultation.

Make your next move with confidence.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).