Understanding Fed Expectations and Interest Rates

Interest rates have been the main driver of the real estate market since 2022. After hiking rates from near 0% to 5.25–5.50%, the Fed now signals an upcoming easing cycle. With inflation near 2%, markets expect two or three rate cuts (about 1%) in the next year.

But should you wait for lower rates—or act before the market adjusts?

1. What the Fed Is Signaling

Mortgage rates follow long-term Treasury yields, which often move before the Fed does. As of late 2025, the 10-year yield has already dipped from 4.7% to 4.2%, suggesting borrowing costs may soon decline.

2. How Lower Rates Impact Payments

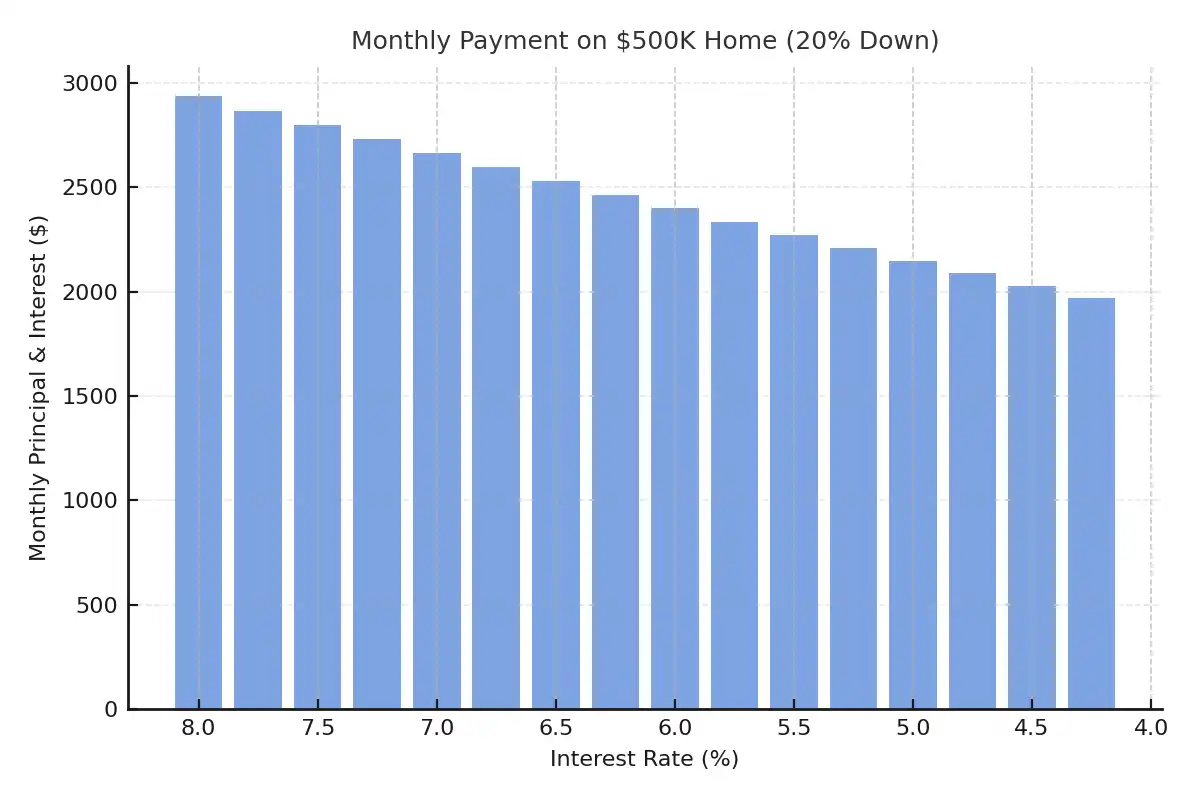

On a $500K home with 20% down, here’s how monthly payments change as rates fall:

| Rate | Monthly (P&I) | Change |

| 7.25% | $2,728 | — |

| 6.50% | $2,528 | –$200 |

| 5.75% | $2,334 | –$394 |

A 1% drop in mortgage rates typically reduces payments by 10–12%—or increases buying power by the same amount.

3. Why Waiting Isn’t Risk-Free

When rates fall, competition heats up. Earlier this year, a 0.5% drop in rates led to a 15% jump in mortgage applications, and prices in several metros rose 3–5% within a single quarter.

If prices rise 5% while waiting for a 0.5% drop, the affordability gain can vanish.

4. Investors: Rate Cuts and Cap Rates

For investors, falling rates can quickly lift property values.

Example: a duplex generating $48K NOI.

| Mortgage Rate | Cap Rate | Approx. Value |

| 7.0% | 7.5% | $640K |

| 6.0% | 6.8% | $706K |

| 5.5% | 6.3% | $762K |

A modest rate decline could add $100K+ in market value.

5. The Smart Approach

- Buy when fundamentals align, not when rates bottom out.

- Refinance later—many lenders now offer low-cost refi options within 24 months.

- Investors: underwrite deals using today’s rates but price in future upside.

Markets move on expectations, not announcements—early movers usually gain the advantage.

Final Thought

The Fed’s next easing cycle could redefine affordability and returns in 2026. Whether purchasing a home or an investment property, the right time isn’t when rates hit their lowest—it’s when the numbers and your goals align.

At Unda Realty Group, we help clients navigate shifting rate cycles with data-driven insights and strategies that turn timing into opportunity.

Social Cookies

Social Cookies are used to enable you to share pages and content you find interesting throughout the website through third-party social networking or other websites (including, potentially for advertising purposes related to social networking).